A bill seeking to regulate employment practices in Nigeria’s banking sector has passed second reading in the House of Representatives.

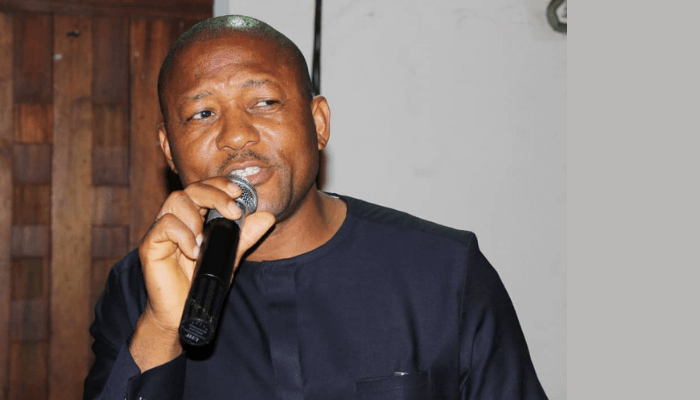

The proposed legislation, sponsored by Mr. Fuad Laguda, an All Progressives Congress (APC) lawmaker representing the Surulere I Federal Constituency of Lagos State, aims to amend the Banks and Other Financial Institutions Act (BOFIA) 2020 to prohibit, criminalise and penalise the use of casual and contract staff by banks.

Leading the debate during Thursday’s plenary, Mr. Laguda said the bill is designed to “totally mitigate” the widespread use of casual and contract employment in the banking industry and to address what he described as the “exploitative and oppressive treatment of millions” of Nigerians engaged under such arrangements.

He argued that existing labour laws do not adequately protect such workers, noting that the Labour Act 2004 and the Employees’ Compensation Act (ECA) 2010 fail to provide sufficient welfare safeguards for casual and contract staff.

Citing a 2023 report by the Chartered Institute of Bankers of Nigeria (CIBN), Mr. Laguda said banks have increasingly relied on casual and contract workers to reduce operational costs associated with pensions, minimum wage compliance, health insurance, promotions, bonuses, study grants and severance benefits.

According to him, casual and contract workers now account for about 65 per cent of the total workforce in Nigerian banks. He stressed that the bill seeks to promote fairness and equitable treatment across the sector.

Mr. Laguda further said the proposed law is intended to curb what he termed the “heinous practices” of banks that breach Section 7(1) of the Labour Act 2004, which stipulates that an employee should not be engaged for more than three months without formal recognition of such employment.

“I urge my colleagues to support this bill because it corresponds with the viewpoints of the Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, who has said that casual and contract staff in Nigerian banks are exposed to poor working conditions,” he told lawmakers.

He added that banks often use casual and contract arrangements to evade legal and contractual obligations, leaving workers vulnerable to systemic inequality, emotional abuse and mental health challenges.

When the bill was put to a voice vote by the Deputy Speaker, Mr. Benjamin Kalu, lawmakers unanimously voted in favour of its passage to the next legislative stage.