The new tax regime under President Bola Tinubu has raised concerns of double taxation and the overall burden on workers.

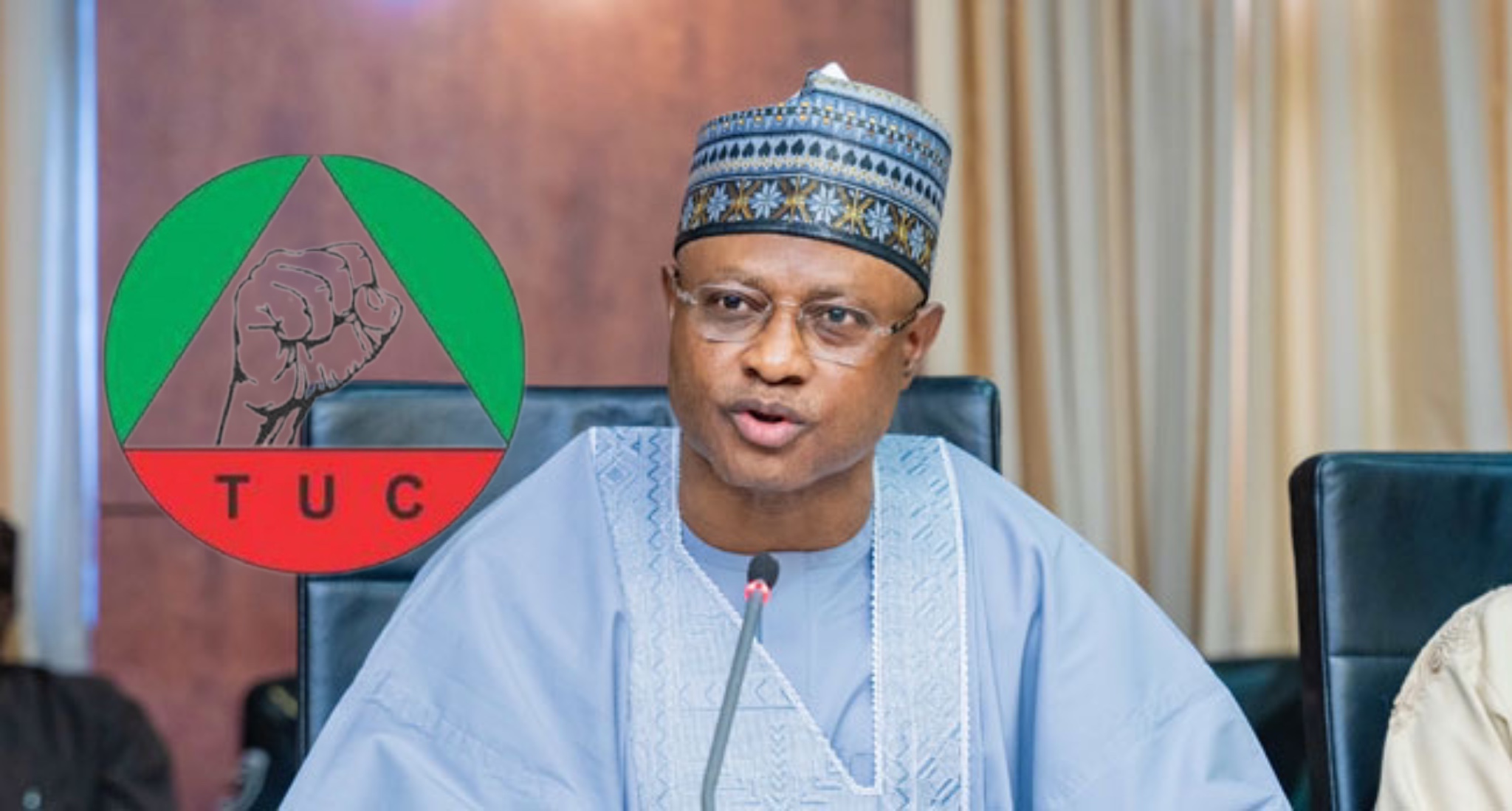

Tinubu in June 2025 signed the Nigeria Tax Reform Acts into law, a sweeping overhaul of the nation’s tax system that will affect both workers and businesses. The legislation, prepared by the Taiwo Oyedele-led Presidential Committee on Fiscal Policy and Tax Reforms, consolidates several existing tax laws into a single framework.

The reforms are intended to simplify tax administration, broaden the tax base, and boost government revenue. However, the changes to the Personal Income Tax (PIT) provisions have drawn mixed reactions, particularly from salary earners.

Emmanuel Ugu, a civil servant, described the new arrangement as “double taxation,” adding, “the government will deduct tax from our salaries through the Pay-As-You-Earn (PAYE) model and still go ahead to tax any extra money in our bank accounts. That is unfair.”

On his part, Policy analyst Abbas Sule, voiced his concerns about the new tax regime, stressing that the exemption level of ₦800,000 a year translates to only ₦67,000 a month. “This means minimum wage earners on ₦70,000 per month will still pay tax,” he argued.

Under the new law, individuals earning ₦800,000 or less annually are exempt from PIT, while those above this threshold will face progressive tax rates rising to as high as 25 per cent.

Some employees argue that this will increase their financial strain.

But Oyedele, who chairs the Presidential Tax Reform Committee, dismissed fears that the law will increase the burden on workers. He noted that the old tax table, unchanged since 2011, had become regressive due to inflation.

“An individual earning just ₦400,000 a month was paying the same top marginal tax rate as someone earning ₦20 million. That was unfair. With the new law, workers on the minimum wage or slightly above will be exempt, while over 90 per cent of employees in both public and private sectors will actually pay less,” Oyedele said.

While higher-income earners are expected to contribute more, some experts welcome the reforms. Professor Uche Uwaleke, President of the Capital Market Academics of Nigeria, said the new framework would benefit businesses and the capital market through lower company income tax rates and incentives for small firms.

Even so, labour analysts argue that the real test lies in implementation. Workers’ unions and policy observers are urging the government to ensure that low-income earners are not left worse off. The debate over fairness, revenue generation, and economic growth is likely to persist as the law takes effect.